Digital or decline: Covid-19 has accelerated the need for digital strategy

Big cities may rely on historical sights and antique treasures to draw in the tourists, but they can still benefit from infrastructure upgrades. Driving this evolution in the near-future will be tourism, one of the industries most rocked by Covid-19 that is steadily preparing for a post-pandemic world in which people are free to travel again.

Covid-19 hit the travel industry harder than almost any other industry, and the pandemic has also revealed the need to invest in an online digital strategy. Covid-19 presented an unprecedented challenge to the travel industry. However, Covid-19 has been a temporary setback to online travel and long-term, the impact could be beneficial.

Stay-at-home orders implemented led to digital acceleration with more consumers becoming adept at using technological solutions in everyday life including for online shopping, virtual meetings, and online banking. GlobalData’s Q4 2021 Consumer Survey* revealed that in the last three months, because of Covid-19, 89% of global respondents indicated that they were spending time online in general. In comparison, just 11% of global respondents either reduced the amount of time spend online or never/stopped spending time online.

Covid-19 has accelerated need for robust digital strategy

Moreover, Covid-19 highlighted the need to reduce physical contact and consumers are more likely to carry out transactions online than in-store. A GlobalData Survey*, 76% of global respondents indicated they were buying non-grocery products online because of Covid-19.

However, online shopping behaviour varies; 28% of Silent Generation respondents reporting that they never purchased non-grocery products online. While this may indicate the importance of retaining an offline presence to entice older holidaymakers, who typically travel year-round and for longer periods of time, the trend towards online firmly continues.

Serving as a reminder of this is the rebranding of the former brick-and-mortar travel agent, Thomas Cook, into digital only company and the success of born digital and technology forward travel companies, such as Airbnb and Trip.com. Undoubtedly, a visible, active, and authentic online presence is of pivotal importance to succeed as travel recovers.

Online travel market value overtook offline in 2019

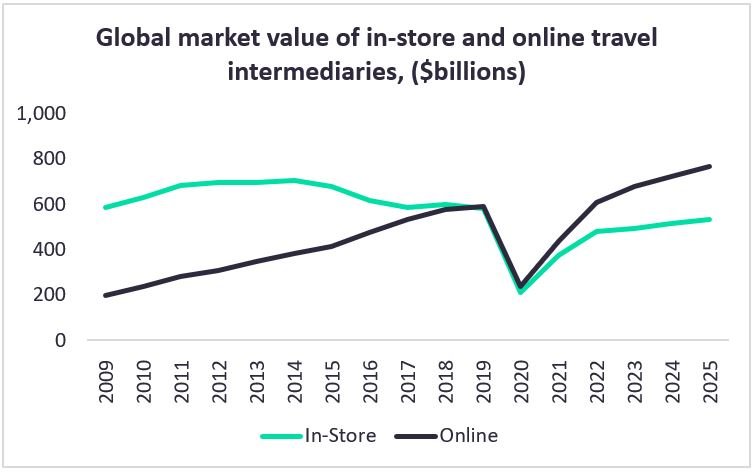

Demonstrating the importance of cultivating a digital presence is the rapid growth of online travel intermediary market value. Globally, online market value reached $592.5 billion in 2019 (CAGR 2015-19: 9.3%), to overtake in-store. Meanwhile, in-store market value declined at a CAGR of 3.8% between 2015 and 2019.

Indicatively, GlobalData’s Q4 2021 Consumer Survey* reveals that 24% of global respondents used an OTA the last time they booked a holiday, the most popular option. This was true across most age groups, including Gen Z (15%), Millennials (23%), Gen X (26%) and Boomers (24%). However, Silent Generation respondents gravitated towards booking directly with lodging providers (23%), more so than OTAs (18%).

Entering Covid-19, global international departures plummeted 69% YoY to 465.9 million in 2020 and online market value similarly declined by 60.1% to $236.7 billion in 2020. Nevertheless, the online travel market value is expected to exceed pre-pandemic levels, illustrating the resilience of a digitally forward strategy. As the vaccine rollout boosts travel confidence and travel restrictions ease, the online market value is projected to reach $765.3 billion by 2025 (CAGR 2021-25: 15.1%), according to GlobalData forecasts. Customers expect a variety of options for engagement, from websites, apps and social media and travel intermediaries will have to adapt to meet future traveller demands to gain a share of the forecasted $765.3 billion online travel market.

*GlobalData Q4 2021 Consumer Survey – 22,074 respondents.

Main image credit: ASTA Concept / Shutterstock.com

BACK TO TOP

COMMENT